Top 10 Pros and Cons of Leasing Out a Ship

Leasing out your ship can be a strategic move for ship owners looking to generate consistent revenue without the day-to-day operational hassles. However, it’s not without its challenges. Understanding the pros and cons of leasing can help you make an informed decision that aligns with your financial goals and business strategy. In this article, we delve into the top 10 pros and cons of leasing out a ship, providing you with a comprehensive overview of what to expect.

* Please send feedback/suggestions to editor @ shipuniverse.com

PROS

1. Steady Revenue Stream Leasing out your ship provides a consistent and predictable income. Unlike operating the ship yourself, which can involve fluctuating revenues depending on market conditions and cargo availability, a lease agreement typically guarantees a fixed income over the lease period. This steady revenue stream can help stabilize cash flow and provide financial security.

2. Reduced Operational Responsibilities When you lease out your ship, the lessee often takes over the operational responsibilities. This can include everything from crew management and maintenance to compliance with regulatory requirements. By transferring these duties to the lessee, you can reduce the administrative burden and focus on other aspects of your business or investment portfolio.

3. Mitigated Market Risks The shipping market is notoriously volatile, with freight rates subject to rapid changes due to economic shifts, geopolitical events, and seasonal variations. Leasing out your ship can mitigate these market risks by securing a fixed lease rate. This arrangement shields you from the uncertainties of the spot market and helps in maintaining a stable income regardless of market fluctuations.

4. Improved Asset Utilization Leasing out your ship ensures that the asset is continually in use, generating revenue. Idle ships incur costs without producing income, leading to potential financial strain. By leasing, you maximize the utilization of your asset, ensuring it contributes to your financial returns rather than sitting unused in a port.

5. Access to New Markets and Opportunities Leasing your ship to different operators can expose you to new markets and business opportunities. Lessees may use your ship for routes and cargo types that you might not have considered, broadening your understanding of the shipping industry. This can provide insights and experiences that could be beneficial for future investments and strategic decisions.

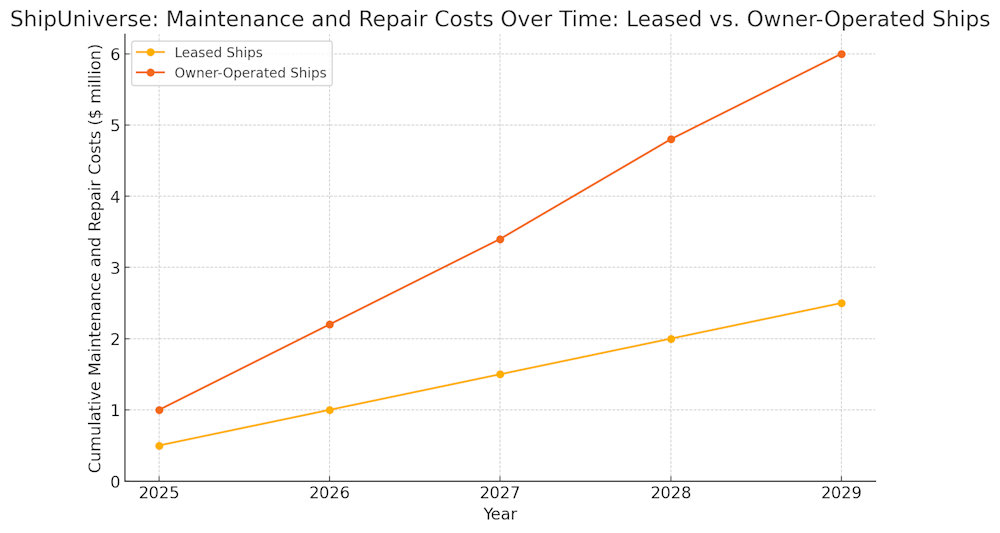

6. Lower Maintenance and Repair Costs In many leasing agreements, the lessee is responsible for the maintenance and repair of the ship during the lease period. This can significantly reduce your maintenance expenses and ensure that the ship is kept in good working condition. The lessee’s interest in maintaining the vessel well also aligns with your interest in preserving the asset’s value for the long term.

7. Flexibility in Asset Management Leasing out your ship provides flexibility in asset management. You can choose short-term or long-term leases depending on your financial goals and market conditions. This flexibility allows you to adapt quickly to changing market dynamics, re-lease to different operators, or sell the ship if a favorable opportunity arises.

8. Enhanced Financial Planning With a lease agreement in place, you can better forecast your financials. The predictable income from leasing makes it easier to plan for future investments, debt servicing, and other financial commitments. This enhanced financial planning capability can lead to more strategic and informed business decisions.

9. Diversification of Revenue Streams Leasing your ship adds another revenue stream to your portfolio, diversifying your income sources. This diversification can reduce your overall financial risk, as you are not solely dependent on operating your own fleet or a single line of business. It can also provide a buffer against downturns in other areas of your business.

10. Potential Tax Benefits In some jurisdictions, leasing out your ship can offer tax advantages. Lease income might be treated differently from operating income, potentially resulting in favorable tax treatment. Additionally, you may be able to deduct certain expenses related to leasing, such as depreciation, which can reduce your taxable income and improve your overall financial position.

CONS

1. Loss of Direct Control One of the primary disadvantages of leasing out your ship is the loss of direct control over the asset. When you lease your ship to another operator, you relinquish day-to-day management and decision-making. This can lead to concerns about how the lessee operates and maintains the vessel, potentially impacting its long-term value and condition.

2. Potential for Wear and Tear Leasing out your ship means it will be used by other operators, which can result in increased wear and tear. While maintenance responsibilities may be specified in the lease agreement, the lessee’s standards may not match your own. This can lead to accelerated depreciation and unexpected repair costs once the ship is returned.

3. Financial Risk of Lessee Default There is always a risk that the lessee may default on the lease payments, especially in volatile economic conditions or downturns in the shipping industry. A default can disrupt your expected revenue stream and potentially lead to costly legal disputes. Ensuring that you lease to financially stable and reputable operators is crucial, but this risk can never be entirely eliminated.

4. Limited Flexibility During Lease Term Once you lease out your ship, your ability to use or repurpose it is limited for the duration of the lease agreement. This can be a disadvantage if market conditions change and you find more profitable opportunities for your vessel. The lease agreement locks you into a fixed arrangement, reducing your flexibility to respond to new business prospects.

5. Dependency on Lessee’s Operational Competence The success of leasing out your ship heavily depends on the lessee’s operational competence. If the lessee is inefficient, unable to secure profitable routes, or faces operational issues, it could affect their ability to make timely lease payments. Additionally, poor management by the lessee can damage your ship’s reputation and future earning potential.

6. Legal and Contractual Risks Entering into a lease agreement involves navigating complex legal and contractual landscapes. Any ambiguity or oversight in the contract can lead to disputes, misunderstandings, or financial losses. Ensuring that the lease agreement is comprehensive, clear, and enforceable requires legal expertise, and managing these contracts can be resource-intensive.

7. Potential Misalignment of Interests The lessee’s goals and priorities may not always align with yours. While you might prioritize long-term asset preservation and value, the lessee might focus on maximizing short-term profits, potentially at the expense of the ship’s condition. This misalignment can lead to conflicts and require close monitoring to ensure that your asset is being managed in a way that meets your long-term interests.

8. Market Depreciation Risk If the shipping market experiences a downturn during the lease period, the value of your ship could depreciate significantly by the time the lease ends. This depreciation can affect your overall asset value and potential resale price. Additionally, if you wish to re-lease the ship after the initial lease term, you may face lower lease rates due to the depressed market conditions.

9. Regulatory and Compliance Challenges Leasing out your ship involves ensuring that both you and the lessee comply with various international, national, and local regulations. These regulations can change frequently and vary by region, creating potential compliance challenges. Non-compliance by the lessee can result in fines, legal issues, and damage to your reputation as the ship owner.

10. Insurance Complications Insurance arrangements can become more complex when leasing out a ship. You need to ensure that the lessee has adequate insurance coverage for the vessel and its operations. Any gaps in coverage or disputes over liability in case of accidents or damages can lead to significant financial exposure and legal battles. Properly structuring and monitoring insurance policies is crucial but can be time-consuming and challenging.

Leasing out a ship presents a balanced mix of benefits and drawbacks. While it offers a steady income stream, operational relief, and financial predictability, it also comes with risks such as loss of control, increased wear and tear, and potential legal complications. By carefully evaluating these factors, ship owners can determine whether leasing aligns with their long-term objectives and market conditions. Making an informed decision will ensure that you maximize the value and profitability of your shipping assets.

Do you have any feedback or additional insights? Please reach out to editor @ shipuniverse.com