Ship Financing: 30 Creative Solutions

Financing is a pivotal element for ship and fleet owners looking to expand, upgrade, or maintain their operations. Traditional lending sources, like banks and financial institutions, have been the mainstay, but a range of innovative financing solutions has emerged. These creative options can provide more flexibility, lower costs, and tailored terms, helping ship owners navigate the complex financial seas. Here, we explore thirty creative financing solutions designed to fuel the maritime industry’s growth.

* Please send feedback/suggestions to editor @ shipuniverse.com

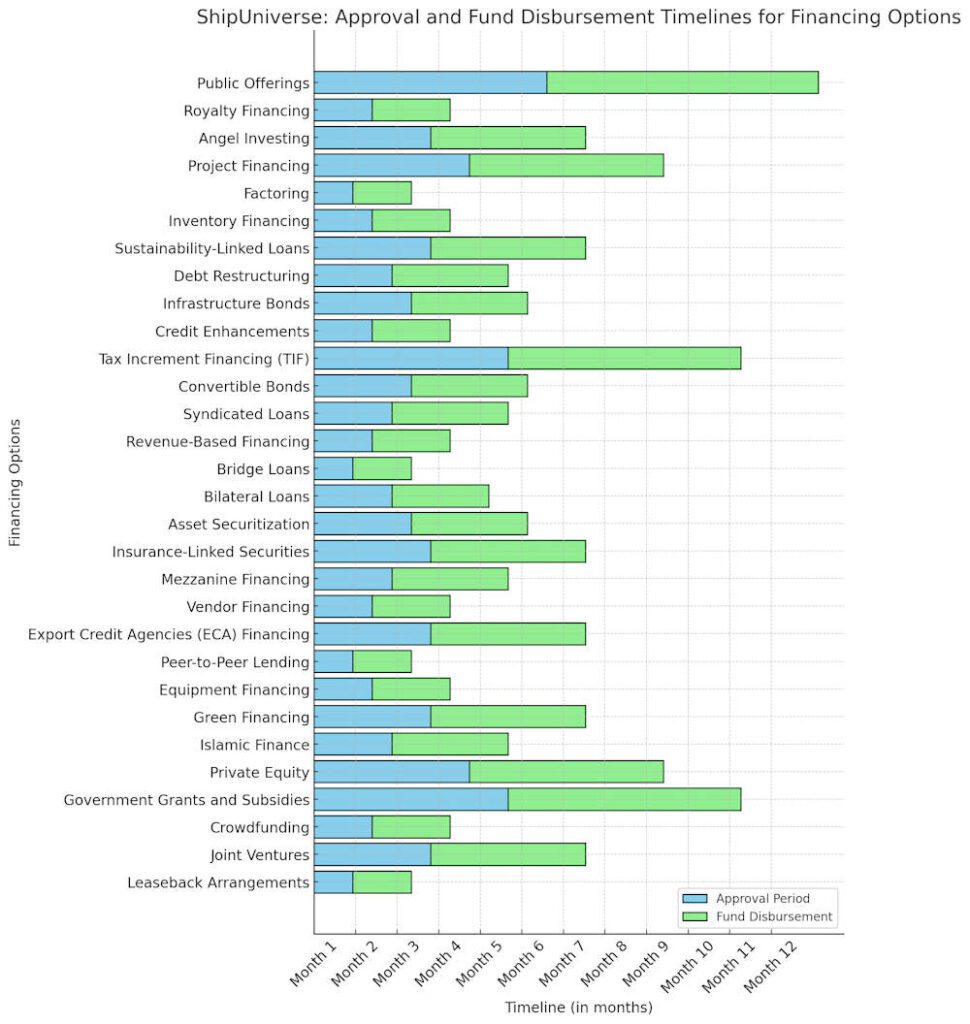

- The above chart serves as a general guide. Keep in mind that these figures can vary significantly depending on the unique circumstances of both the lender and the borrower.

1. Leaseback Arrangements

A sale and leaseback arrangement involves a ship owner selling a vessel to a financial entity and then leasing it back for a long-term period. This solution frees up capital while allowing the ship owner to retain operational control. It’s particularly useful for owners needing liquidity without wanting to compromise their fleet’s operational capacity.

Interest Rates: Interest rates can vary greatly depending on the creditworthiness of the company and the terms of the deal but generally range from 4% to 8%.

2. Joint Ventures

Entering into a joint venture allows multiple parties to pool resources for the purchase and operation of a ship. This method dilutes individual risk and capital requirement. It’s ideal for smaller operators who wish to expand their fleet but are cautious about the high capital expenditure and associated risks. Joint ventures also open avenues for sharing technical expertise and market reach.

Interest Rates: This option doesn’t typically involve interest rates as it’s more about equity sharing and pooling resources rather than borrowing.

3. Crowdfunding

An innovative approach that is gaining traction in various sectors is crowdfunding, where capital is raised through small contributions from a large number of investors, typically via online platforms. For the maritime sector, this can be a way to gather funds for new ships or retrofitting projects, especially appealing to environmentally conscious projects aiming for green technologies.

Interest Rates: Usually doesn’t involve interest payments. Returns to investors might be in the form of product rewards, equity, or profit sharing, depending on the crowdfunding model.

4. Government Grants and Subsidies

Many governments offer grants and subsidies to promote maritime activities that align with national interests such as shipping security, environmental improvements, or boosting maritime innovation. Ship owners can significantly benefit from such programs by receiving non-repayable funds or incentives that reduce the financial burden of upgrading fleets with new technology or complying with international regulations.

Interest Rates: These are typically interest-free as they are not loans but rather grants or subsidies provided to support certain activities or policies.

5. Private Equity

Private equity involves funds and investors that directly invest capital in a company—in this case, a shipping operation. Often, these investors are willing to take on more risk for the potential of higher returns. This can be a robust financing solution for ship owners looking to innovate, restructure, or expand their fleets without taking on traditional debt.

Interest Rates: Involves selling equity, not borrowing, so there are no interest rates. Instead, investors gain a return on investment based on the company’s performance.

Get Competitive Maritime Financing Quotes Today6. Islamic Finance

Islamic finance provides a unique structure that complies with Sharia law, which prohibits interest. Instruments like Sukuk, which are Islamic equivalent of bonds, offer ship and fleet owners a way to raise capital through asset-based financing. This approach is especially appealing in regions where traditional interest-bearing loans are not culturally acceptable or legal.

Interest Rates: Does not involve interest due to Sharia law compliance. Instead, returns are based on asset leasing agreements or profit sharing, often perceived as equivalent to interest rates ranging from 3% to 6%.

7. Green Financing

As the maritime industry moves towards sustainability, green financing has become increasingly popular. These loans or investments are specifically earmarked for projects that improve environmental performance, such as retrofitting older vessels with cleaner technology or building new eco-friendly ships. Accessing green financing can also come with reputational benefits and potential cost savings in terms of fuel and compliance with global emission standards.

Interest Rates: Interest rates for green loans can be lower than standard commercial loans due to subsidies or incentives aimed at promoting sustainable projects. Rates might range from 2% to 6%.

8. Equipment Financing

For many ship owners, the need isn’t always about acquiring new ships but upgrading existing ones with the latest technology. Equipment financing allows owners to purchase new machinery or retrofit existing equipment without paying the full cost upfront. This type of financing is generally secured against the equipment itself, potentially offering lower interest rates compared to unsecured loans.

Interest Rates: Rates can vary widely based on the risk and the assets being financed but generally range from 4% to 10%.

9. Peer-to-Peer Lending

This innovative financing method connects borrowers directly to lenders through online platforms, bypassing traditional financial intermediaries. For ship and fleet owners, peer-to-peer lending can be a more flexible and quicker alternative for obtaining funds, especially for smaller scale or shorter-term financial needs.

Interest Rates: Interest rates can be competitive, depending on the risk profile and the platform’s terms, typically ranging from 5% to 15%.

10. Export Credit Agencies (ECA) Financing

Export Credit Agencies provide guarantees and insurance to lenders to facilitate the export and import of goods, including ships. ECA financing can help ship owners secure loans under more favorable terms than those available in the commercial market, making it easier to purchase new vessels or upgrade existing ones. This is particularly valuable for companies operating in international waters and dealing with cross-border transactions.

Interest Rates: Often offers lower interest rates due to government backing, typically ranging from 2% to 5%.

11. Vendor Financing

In vendor financing, the supplier of the ship or equipment offers loans or deferred payment terms to the buyer. This method is beneficial for ship and fleet owners who may not have immediate funds but can manage payments over time. Suppliers may offer competitive rates or terms to facilitate the sale, making it a win-win situation for both parties.

Interest Rates: Interest rates can vary depending on the vendor and the buyer’s creditworthiness, typically ranging from 5% to 15%. The rate might be lower if the vendor is motivated to push through a sale.

12. Mezzanine Financing

Mezzanine financing is a hybrid of debt and equity financing that gives the lender the right to convert to an equity interest in the company in case of default, generally after venture capital companies and other senior lenders are paid. This type of financing is useful for ship owners who need larger amounts of capital and are willing to share potential future profits in exchange for immediate capital infusion.

Interest Rates: This type of financing is higher risk and therefore generally carries higher interest rates, often ranging from 12% to 20%. It combines debt and equity elements, where the cost reflects the increased risk to the lender.

13. Insurance-Linked Securities

This innovative approach involves the securitization of insurance risks, including those related to maritime operations. Ship owners can use insurance-linked securities to manage and transfer risks, such as those from natural disasters or operational failures, to investors, thereby securing upfront capital that can be used for enhancing fleet capabilities or as a financial safety net.

Interest Rates: These do not typically involve traditional interest rates but rather returns based on insurance risk calculations. Returns can vary widely but are generally comparable to high-yield debt instruments.

14. Asset Securitization

Asset securitization involves pooling various financial assets and selling them to a special purpose entity, which then issues securities backed by these assets. For ship owners, this could mean securitizing revenue-earning contracts or even the ships themselves. This method can unlock significant capital tied up in assets, providing liquidity to fund operations or growth initiatives.

Interest Rates: Interest rates for securities backed by assets such as ships or revenue contracts can vary, typically ranging from 4% to 8%, depending on the credit quality of the underlying assets and market conditions.

15. Bilateral Loans

Bilateral loans are direct loans from a single lender to a borrower. In the maritime industry, these are often negotiated with banks that have a focus on maritime financing. The terms and conditions are usually highly customized to fit the specific needs and risk profiles of the ship or fleet owners. These loans can be advantageous for financing specific ships or projects with clear cost structures and timelines.

Interest Rates: Interest rates on these loans depend on the relationship between the lender and borrower and the associated risk, generally ranging from 3% to 10%.

16. Bridge Loans

Bridge loans are short-term financing options used to cover immediate expenses until permanent financing is secured. For ship and fleet owners, this can be critical when waiting for funds from longer-term loans or other financing arrangements to come through. Bridge loans provide the liquidity needed to keep operations running smoothly or to seize quick opportunities in the market.

Interest Rates: These are short-term and typically higher-risk, thus carrying higher interest rates ranging from 8% to 15%.

17. Revenue-Based Financing

This type of financing allows ship owners to repay loans based on a percentage of their monthly revenues. It is especially useful for fleets with fluctuating income, as payments adjust based on cash flow, reducing financial pressure during slower periods. This flexible repayment structure can be advantageous for operators in seasonal maritime sectors.

Interest Rates: This financing does not typically involve an interest rate per se but rather a fixed percentage of revenue until the agreed amount is repaid. The effective “rate” can be variable and depends greatly on the business’s revenue performance.

18. Syndicated Loans

In syndicated loans, multiple lenders pool resources to provide a borrower with a large loan while spreading the risk among themselves. For major acquisitions, such as a fleet expansion or extensive refit projects, syndicated loans can provide necessary large capital amounts that might be too risky for a single lender. This is particularly valuable for large-scale ship operators looking to undertake significant investments.

Interest Rates: Given the shared risk among multiple lenders, these loans can offer competitive rates, generally ranging from 3% to 7%, depending on the consortium’s assessment of the risk.

19. Convertible Bonds

Convertible bonds are a type of bond that the holder can convert into a predetermined number of shares of the issuing company. This financing option provides ship owners with the ability to raise funds at lower interest rates while giving investors an opportunity to convert their bonds into equity if the company performs well. It’s an attractive option for companies with strong growth prospects.

Interest Rates: The interest rates on convertible bonds are generally lower than standard bonds due to the conversion feature, typically ranging from 2% to 6%.

20. Tax Increment Financing (TIF)

Tax Increment Financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects. In the maritime context, TIF can be used to fund infrastructure improvements at ports or development areas that directly benefit ship and fleet operations. This tool helps to leverage public funds to increase private sector investment in critical maritime infrastructure.

Interest Rates: This public financing method usually doesn’t have traditional interest rates as it’s based on future gains in tax revenues, but the implied costs can vary depending on the project and the municipal arrangements.

Get Competitive Maritime Financing Quotes Today21. Credit Enhancements

Credit enhancements involve using various tools or agreements to improve the credit profile of a financing transaction, thereby reducing the risk for lenders. This can include guarantees, insurance, or reserve accounts. For ship and fleet owners, these enhancements can make it easier to obtain financing on better terms by providing additional security to lenders.

Interest Rates: The interest rate itself isn’t directly impacted by credit enhancements, but these tools can lower the effective interest rates by reducing the risk perceived by lenders. The reduction can vary widely depending on the type of enhancement used.

22. Infrastructure Bonds

Infrastructure bonds are long-term securities issued by governments or corporations to fund infrastructure projects, including those related to maritime facilities such as ports and shipyards. For ship owners, investing in or leveraging these bonds can be part of a strategic approach to enhance the infrastructure they depend on, potentially lowering operational costs and increasing efficiency.

Interest Rates: Interest rates for infrastructure bonds generally reflect government or corporate bond rates, typically ranging from 3% to 6%. These rates are influenced by the bond’s duration, risk, and the creditworthiness of the issuer.

23. Debt Restructuring

Debt restructuring involves modifying the terms of existing debt to achieve some advantage, either by reducing the interest rate, extending the payment schedule, or negotiating lower repayments. For ship and fleet owners facing financial challenges, restructuring debt can provide much-needed breathing room to stabilize operations and return to profitability.

Interest Rates: In a debt restructuring scenario, the new interest rate depends on the negotiation between the debtor and creditors. The goal is often to lower the rates to make payments more manageable, possibly reducing existing rates by several percentage points.

24. Sustainability-Linked Loans

Sustainability-linked loans are designed to incentivize borrowers’ commitment to achieving agreed-upon environmental, social, and governance (ESG) goals. These loans typically offer lower interest rates as targets are met, making them an attractive option for ship owners investing in sustainable operations and technologies, aligning financial and environmental objectives.

Interest Rates: These can offer lower interest rates if sustainability performance targets are met. The rates can vary but often start slightly lower than conventional loans, with further reductions as targets are achieved, ranging from 2% to 5%.

25. Inventory Financing

Inventory financing refers to using the inventory of a business, such as spare parts for ships or unbought vessels, as collateral for a loan. This type of financing is particularly useful for shipyards or fleet owners who hold significant amounts of inventory and need liquidity to fund operations or new projects.

Interest Rates: Rates for inventory financing depend on the risk associated with the inventory’s value and liquidity. Typically, rates can range from 6% to 15%.

26. Factoring

Factoring involves a business selling its invoices at a discount to a third party, called a factor, in exchange for immediate cash. This can be particularly useful for ship management companies or fleet operators who have long payment terms with clients but need immediate funds to manage day-to-day operations or unexpected expenses.

Interest Rates: The cost of factoring isn’t a traditional interest rate but rather a fee based on a percentage of the invoice value. This fee can range from 1% to 5% per month, depending on the industry, the volume of invoices, and the credit risk of the debtors.

27. Project Financing

Project financing is a loan structure that relies primarily on the project’s cash flow for repayment, with the project’s assets, rights, and interests held as secondary collateral. This type of financing is ideal for new ship construction or large-scale upgrade projects where the investment is significant, and the revenue generated from the project is expected to pay back the borrowed funds.

Interest Rates: Given its reliance on project cash flows and the higher risk associated with standalone projects, interest rates can be higher, ranging from 5% to 15%.

28. Angel Investing

Angel investors are individuals who provide capital for a business start-up, usually in exchange for convertible debt or ownership equity. In the maritime industry, angel investors can be particularly interested in innovative maritime technologies or start-ups with the potential to disrupt traditional shipping methods. This is an excellent option for entrepreneurs in the maritime sector looking to kickstart their projects with a strong financial backing.

Interest Rates: Like private equity, angel investing involves equity rather than debt, so there are no interest rates. Investors expect a return on their equity investment, typically looking for significant gains upon exit rather than periodic interest payments.

29. Royalty Financing

Royalty financing involves raising capital from investors who receive a percentage of the company’s revenue over a certain period. For ship owners, this means no need to give up equity or take on debt. Instead, they pay a portion of their earnings from specific vessels or routes. This type of financing is attractive for companies with steady revenue streams but who wish to avoid traditional debt or equity dilution.

Interest Rates: This financing method involves payments based on revenue rather than interest rates. The royalty rate can vary widely but generally ranges from 2% to 6% of revenue.

30. Public Offerings

Public offerings involve a company selling shares to the public to raise funds. For established shipping companies, this can be a way to access significant amounts of capital, though it comes with increased regulatory requirements and public scrutiny. Public offerings are ideal for large-scale expansion projects or when transitioning from a private to a public company to tap into broader financial markets.

Interest Rates: With public offerings, companies raise capital by selling shares, not by borrowing, so there are no interest rates involved. Instead, shareholders expect dividends and appreciation in share value based on the company’s performance.

We have now explored thirty creative solutions for ship and fleet financing, each offering distinct advantages and suited to different strategic needs. From leveraging current assets through factoring and inventory financing to engaging with investors via angel investing and public offerings, the options are diverse. Navigating this landscape effectively requires a thorough understanding of each method’s nuances and aligning them with the company’s long-term goals and operational realities. With the right financial strategy, ship and fleet owners can ensure robust growth and sustainability in the competitive maritime industry.

Do you have any feedback or additional insights? Please reach out to editor @ shipuniverse.com