Subscribe to the Ship Universe Weekly Newsletter

From Brussels’ accelerated push to cut Russian LNG to six-figure VLCC earnings and a surprise U.S. mariner rule change, this week’s moves have immediate cash-flow consequences. Insurance costs are climbing, carriers face a new U.S. fee regime, and shipbuilding strategy is tilting toward American capacity. Here’s what actually moves the bottom line and how it'doing it.

Top Developments Impacting Maritime P&L - Sept 19, 2025

Item

What Happened & Who’s Affected

Business Mechanics

Bottom-Line Effect

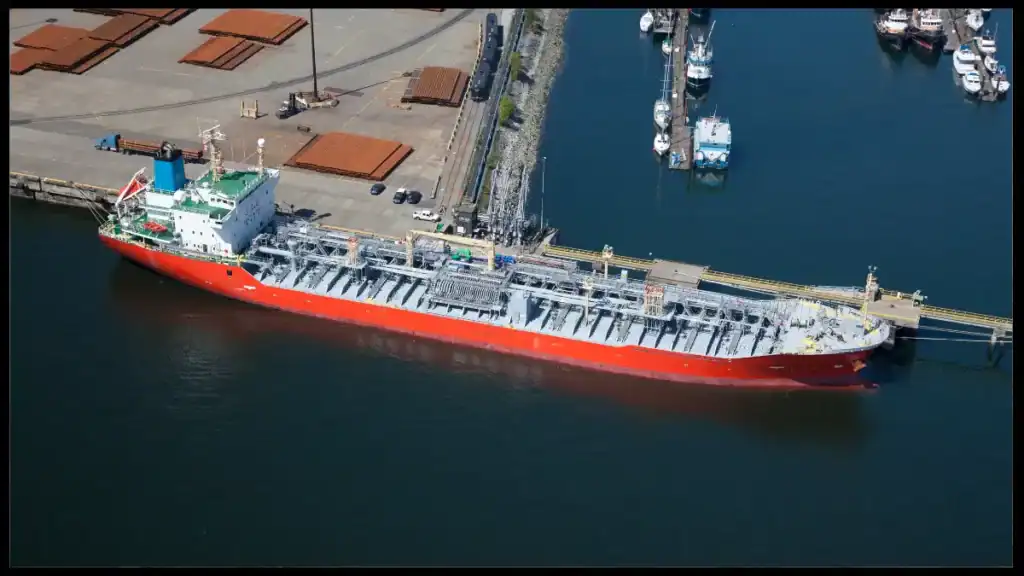

EU accelerates Russian LNG phase-out

Europe prepares earlier curbs on Russian LNG. Affects LNG carriers, traders, European terminals, and Russia-linked logistics.

Re-sourcing to non-Russian supply; longer tonne-miles on Atlantic/Pacific routes; portfolio reshuffles.

📈 Utilization and pricing power for non-Russian routes; 📉 demand for Russia-linked flows.

VLCC spot rates surge

Crude markets tighten; prompt VLCC earnings climb and lift Suezmax/Aframax sentiment.

Tighter tonnage lists; longer voyages; demurrage risk rises with congestion/weather.

📈 Immediate TCE uplift for crude owners; 📉 higher freight for charterers and refiners.

P&I claims at decade high

Clubs face elevated large-loss frequency and severity. Owners, managers, brokers affected at renewal.

Premiums/deductibles grind higher; tighter cover terms; more loss-prevention requirements.

📉 Opex up and cash-timing strain for owners; 📈 revenue tailwind for insurance services.

U.S. port fee regime for China-linked tonnage

New fees approach implementation. Affects carriers with China nexus, BCOs, and U.S. gateways.

Pass-through via GRIs/surcharges tested; contract clauses revisited; potential routing shifts.

↔ If recovery holds; 📉 margin squeeze if competition caps pass-through.

USCG extends mariner recency window

Sea-service recency extended to 7 years for certain endorsements. Operators, crewing agencies, training providers affected.

Larger eligible talent pool; onboarding/training cycles adjust; overtime pressure eases.

📈 Improved crewing availability; ↔ near-term training spend.

HD Hyundai eyes U.S. shipyard purchase

Talks advance for a U.S. yard acquisition. Impacts defense/Jones Act supply chains and OEM vendors.

Potential capacity boost stateside; localization of spend; competitive dynamics shift for foreign yards.

📈 U.S. yard/service revenue; ↔/📉 pricing leverage for some overseas builders.

Owners push back on IMO Net-Zero Framework

Large owners publicly challenge the policy ahead of vote. Impacts capex timing and financing terms across fleets.

Fuel/engine choices delayed or accelerated depending on final text; lenders weigh policy risk.

↔ Planning uncertainty now; 📈 potential compliance cost clarity later.

U.S. offshore wind legal overhang

Court fight over a major Northeast project continues. WTIV/CSOV demand and port staging hinge on outcome.

Utilization scenarios change with legal milestones; cash flows shift right if delays persist.

📈 If project restarts (utilization/order flow); 📉 if halted (idle assets, delayed revenue).

Note: High-level summary for decision-making; actual impact varies by fleet mix, contract cover, and exposure to affected routes.

📈 Winners

📉 Losers

Non-Russian LNG suppliers: potential demand shift into Atlantic and Middle East flows strengthens liftings and pricing power.LNG carrier operators: longer tonne-miles and diversified sourcing raise utilization and forward coverage.Spot crude tanker owners: higher VLCC prints and spillover to Suezmax and Aframax expand TCEs and demurrage opportunities.U.S. yards and vendors: prospective yard acquisition and defense work channel spend into domestic supply chains.Insurance brokers and clubs with scale: rising claim severity supports premium income and advisory revenue.Ports collecting new U.S. fees: incremental fee intake and stickier gateway relationships if volumes hold.Operators with flexible fuel pathways: clearer decarbonization choices improve charterability and financing terms once policy settles.Crewing pools and training providers: extended sea-service recency widens the re-entry funnel and stabilizes manning.

Russia-linked LNG logistics: accelerated European phase-out reduces eligible liftings and raises counterparty risk.Refiners and charterers on crude spot: freight bills climb and budget variance widens during rate spikes.Owners with adverse claims history: higher P&I deductibles and tougher terms lift operating costs.Carriers with China nexus: U.S. fee regime creates margin pressure where pass-through is constrained.Foreign yards without U.S. presence: competitive position erodes on work tied to domestic content and defense.Offshore wind service fleets in limbo: litigation pauses defer utilization and project cash receipts.Capex-heavy fleets amid policy uncertainty: delayed clarity on the Net-Zero Framework stalls investment timing and financing closes.Thin-margin shippers: higher insurance and compliance costs compress landed-cost economics.

View reflects current policy moves, market prints, insurance trends, and yard capacity signals as of September 19, 2025.

Cashflow Barometer

Crude spot earnings (VLCC → Suezmax/Aframax)

LNG tonne-miles (EU shift away from Russian cargoes)

Insurance & P&I opex (claims cycle)

U.S. gateway fee pass-through (China-linked nexus)

Stakeholder

Crude rates

LNG reroutes

Insurance cycle

U.S. fee regime

Spot owners

▲ TCE uplift

▲ Utilization

▼ Margin drag

↔ Depends on recovery

Time-charterers

▼ Hire costs

↔/▲ optionality value

▼ Insurance charges

▼ If pass-through capped

Ports/terminals

▲ Throughput where busy

▲ Bunkering/turns

↔ Compliance workload

▲ Fee intake (select gateways)

Insurers/brokers

↔ Exposure mix

↔ Risk selection

▲ Premiums/deductibles

↔ Policy advice demand

Shipyards/vendors

↔ Ordering mood

↔ Fuel-ready specs

↔ H&M retrofits

▲ U.S. domestic work (if deal closes)

Route Tilt

Atlantic LNG

Traffic bias: ▲

More liftings toward Europe as Russian volumes face headwinds.

Russia ↔ EU LNG

Traffic bias: ▼

Fewer eligible cargoes; counterparty risk higher.

MEG → Asia crude

Traffic bias: ▲/↔

Rate strength spills into adjacent sizes; demurrage risk elevated on delays.

Claims driver

Current signal

Cost implication

Machinery & fire

Elevated frequency/severity

Higher deductibles and loss-prevention requirements

Cargo & handling

Steady to slightly higher

Premium creep; documentation scrutiny

Crew & liability

Under close attention

Wider compliance audits; mental-health and training focus

Labor & Capacity

USCG recency now 7 years

Crewing availability ↑

Training load shifts earlier

Defense/Jones Act yard interest ↑

The profit signals this week lean toward higher volatility: crude spot strength and LNG rerouting are lifting utilization and earnings for well-positioned owners, while a hard insurance market and potential U.S. gateway fees threaten to claw back some of those gains. Crewing relief from the extended recency window can ease operational bottlenecks, but litigation and policy debates still dictate the pace of investment in offshore and low-carbon transitions. Net effect: cash generation improves where exposure is aligned with crude and non-Russian LNG flows, yet cost discipline and contract agility remain essential to keep more of that upside from leaking out via insurance and regulatory friction.

We welcome your feedback, suggestions, corrections, and ideas for enhancements.

Please click here to get in touch .