Panama Canal Port Concessions Face Arbitration as China Retaliates

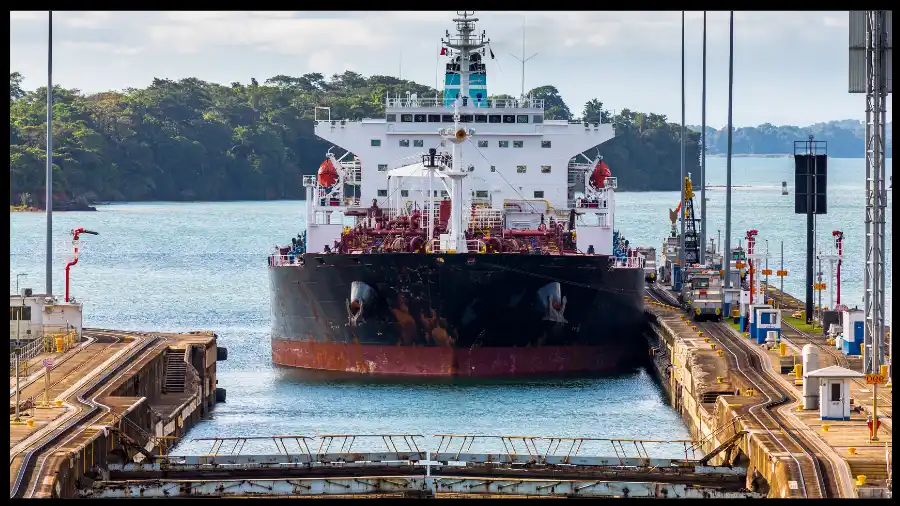

Panama’s Panama Canal port dispute has moved from a legal ruling into a live governance and geopolitics problem. After Panama’s Supreme Court annulled the long-running concession held by a CK Hutchison unit for the Balboa and Cristóbal terminals, the operator launched international arbitration, while Panama’s president signaled future port contracts will not be granted to a single operator. China’s response has sharpened the stakes, with reporting indicating Beijing has told state firms to pause new Panama project talks and weigh other commercial responses.

Subscribe to the Ship Universe Weekly Newsletter

Click here for 30 second summary

Panama Canal ports dispute in one read

Panama’s Supreme Court has annulled the concession framework used by a CK Hutchison unit to operate the Balboa and Cristóbal terminals at either end of the Panama Canal. The operator has initiated international arbitration, while Panama’s president says future port contracts will not be issued to a single operator.

-

Legal posture

The dispute is now positioned as a multi-year legal and governance overhang due to arbitration after the court ruling. -

Policy signal

Panama is publicly framing a different concession approach going forward, which implies a new structure for how operators may be selected. -

External pressure

China’s reaction has intensified attention around investment and commercial posture tied to Panama, increasing the geopolitical temperature around the ports question.

This story raises uncertainty around who controls and administers two strategic terminals linked to the Panama Canal, with immediate knock-on sensitivity for port governance, operator continuity planning, and counterparty comfort until the transition mechanics and timelines are clarified.

| What changed | Current status | What operators should expect | Commercial leverage points | Closest stakeholders |

|---|---|---|---|---|

| Concession ruling shifts the control map |

Panama’s Supreme Court annulled the concession held by a CK Hutchison unit for Balboa and Cristóbal.

Enforcement timing and transition path are still evolving in public reporting.

Governance risk

|

More documentation checks and higher sensitivity around who can sign, approve, and invoice while governance clarifies. | Terminal pricing and slot access become more political. Contracting and renewal tone can change quickly. | Liner operators calling Panama, forwarders, port users on both coasts, and canal-adjacent logistics planners. |

| Arbitration moves it into a long fight |

The operator launched international arbitration against Panama.

Dispute timelines can run long even if daily operations continue.

Legal overhang

|

Expect a longer period of “temporary” operating assumptions, with counterparties asking for clarity in writing. | A legal overhang can delay investment decisions and complicate any asset sale or operator handoff. | Financiers, insurers, counterparties requiring certainty on operator authority and continuity. |

| Panama signals new concession structure |

Panama’s president said future port contracts will not be issued to a single operator.

That implies a more fragmented governance model for future awards.

Policy reset

|

Multi-operator interfaces can add friction in gate rules, billing processes, and service standards during transition. | Splitting operations can reduce single-firm leverage, but it can also create coordination costs. | Shippers with time-sensitive cargo, alliances planning berth windows, inland logistics providers. |

| China’s response raises second-order risk |

Reporting indicates China asked state firms to pause new Panama project talks after the ruling.

China is one of the canal’s largest users, so commercial posture matters.

Geopolitical escalation

|

Watch for altered cargo routing preferences, slower approvals on China-linked projects, and sharper diplomatic messaging. | Retaliation risk shifts from “terminal only” to “broader trade and investment posture.” | Charterers trading into China, Panama exporters/importers, port services tied to China-linked cargo. |

| Interim operator discussions emerge |

APM Terminals said it would be willing to temporarily operate Balboa and Cristóbal if required.

Interim operation depends on legal process and government decisions.

Continuity option

|

If an interim operator steps in, expect short-term process changes: gate appointments, documentation, contacts, and billing. | Continuity reduces disruption risk, but transition periods often create schedule variability. | Carriers with fixed strings through Panama, terminals users needing predictable turn times. |

| Near-term operating reality |

Public reporting indicates the ports may continue operating while timelines settle.

The key is not “shutdown,” it is “uncertainty window.”

Execution risk

|

Build buffer into port calls, and expect elevated counterparty questions around authority, invoices, and service guarantees. | Uncertainty can widen the spread between carriers that can absorb delays and those running tight rotations. | Schedule planners, operations teams, and customers with strict delivery windows. |

What is locked in vs what is still moving

The court ruling and the arbitration launch are now part of the public record, while the practical transition path and timing are the moving pieces that operators will keep watching for in notices and operational instructions.

Attention areas that tend to tighten during concession uncertainty

These are the points where shipping stakeholders most often see extra questions, extra paperwork, or slower confirmation cycles when operator authority and transition mechanics are under debate.

A court-driven reset of Panama Canal terminal concessions, combined with arbitration and a sharper China–Panama exchange, creates a higher-uncertainty operating window around terminal governance, counterpart authority, and any interim operator path for Balboa and Cristóbal.

Panama’s court ruling, the arbitration step, and the sharper China–Panama exchange mean this is no longer just a local concession dispute. For shipping and logistics stakeholders, the practical watchpoints are straightforward: who has clear operating authority at Balboa and Cristóbal, what the interim operating arrangements look like if they change, and how quickly port procedures, billing, and service standards are updated in writing. Until those mechanics are clarified, expect the story to stay active as a governance and continuity risk around a critical canal-linked terminal system.

We welcome your feedback, suggestions, corrections, and ideas for enhancements. Please click here to get in touch.