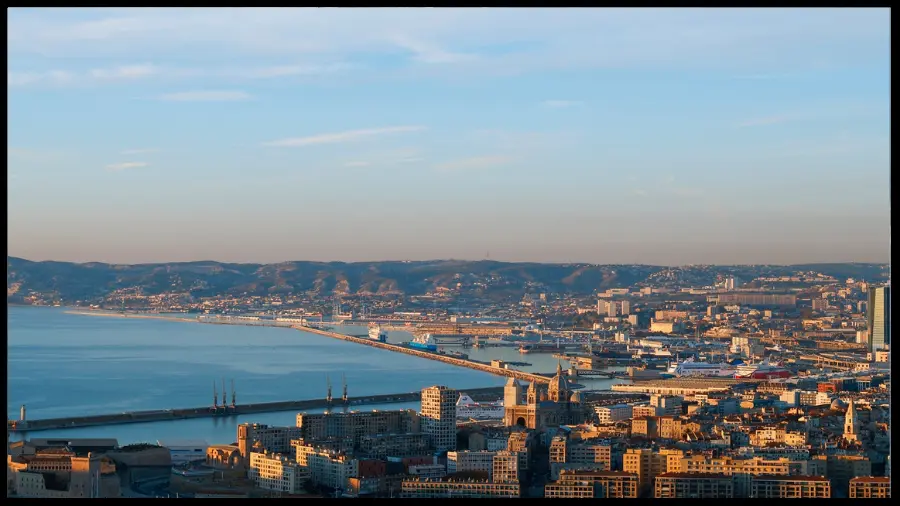

Marseille-Fos Triples Its Bet: €1.3bn Plan To Be South Europe’s Main Gate

Subscribe to the Ship Universe Weekly Newsletter

The port of Marseille-Fos has signed off on a strategic plan for 2025 to 2029 that authorizes up to €1.3 billion in investments, about three times what it spent in the previous five years. The money targets container quays, bulk terminals, energy transition projects, and better rail and river links so the port can anchor more warehouse and industrial projects while competing head-to-head with other Mediterranean hubs. The goal is to lock in Marseille-Fos as the main entry point to southern Europe by 2029, in a market that remains volatile for cargo volumes and energy flows.

Click here for 30 second summary

Marseille-Fos expansion in 30 seconds

Marseille-Fos has signed off on a 2025 to 2029 plan that allows up to €1.3 billion of port investment, roughly three times the last five year cycle. The money targets container and bulk quays, rail and river links, and energy transition projects so the port can act as a main southern gateway into Europe rather than just another Med call.

Extra investment, new bulk and hydrogen projects, and more inland links all land on daily decisions for shipowners, terminals and cargo interests.

Quick read

Segment impact at a glance

Gateway status and bigger-ship readiness

Berth reinforcement and yard upgrades at Marseille and Fos support calls by larger vessels and more stable Med loops, provided that crane productivity and rail or barge evacuation keep pace with ship size.

Multi bulk hub for heavy industry

The long duration Fos multibulk concession and low carbon steel projects give bulk owners a deeper industrial base, with predictable draft, berth access and new flows linked to decarbonised iron and construction demand.

Hydrogen and e fuel ecosystem

Hydrogen refuelling, green fuel studies and synthetic aviation fuel projects in the port zone create an energy logistics cluster that can generate inbound feedstock and outbound product cargoes over the next decade.

- Higher and more predictable port capex supports long term service planning and fleet deployment decisions.

- New logistics and industrial sites near the quays keep more cargo local to the port and cut inland truck legs.

- Rail and river improvements on the Mediterranean Rhone Saone axis strengthen hinterland coverage into France and central Europe.

- Shore power and cleaner industrial projects can improve air quality metrics for ships at berth and surrounding communities.

- Execution risk if construction, permitting or industrial projects lag while costs are already committed.

- Possible tariff pressure as investments roll into port charges and terminal pricing frameworks.

- Modal shift targets rely on rail and barge capacity that must be delivered in step with quay upgrades.

- Stronger competition from other Mediterranean hubs if service quality or inland reach does not improve as planned.

Where the focus sits in practice

2025 to 2029 execution checkpoints

For shipping and logistics stakeholders, the Marseille-Fos expansion is less about a single flagship project and more about how a cluster of moves reshapes the whole basin. Extra spend on quays, bulk facilities and inland links can improve reliability and anchoring of cargo if it is delivered on time and backed by real industrial demand. The same investments will feel like friction if port charges rise faster than service quality or if competing Mediterranean hubs capture the next wave of deep sea strings. The next few years will show whether Marseille-Fos turns this budget into a genuinely stronger southern gateway or just a more expensive one to call.

We welcome your feedback, suggestions, corrections, and ideas for enhancements. Please click here to get in touch.