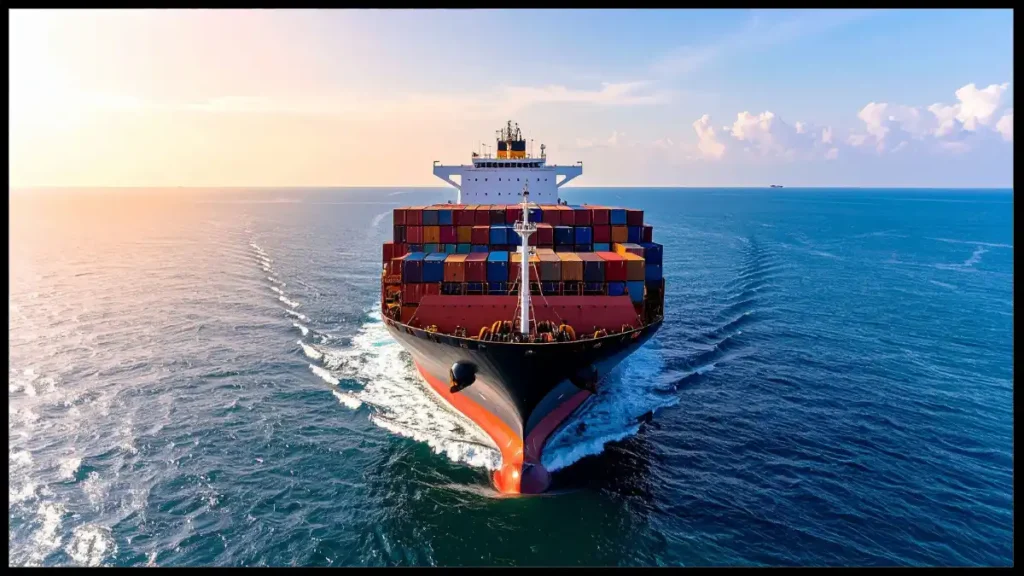

Maersk Stays Cautious on Suez Return as Red Sea Risks Linger

Subscribe to the Ship Universe Weekly Newsletter

Maersk says it will resume using the Red Sea and Suez route only when conditions allow and has not set a firm date, despite signals from Egypt’s Suez Canal Authority about an early-December partial comeback. That leaves many Asia–Europe strings on longer Cape of Good Hope routings, keeping fuel bills high and schedules tight until security and insurance costs clearly improve.

Click here for 30 second summary

Simple Summary in 30 Seconds

Maersk has not set a firm date to fully return via the Suez Canal. Networks still lean on detours through the Cape, which lengthen voyages, raise fuel use, and keep insurance steps in place. A phased comeback would reduce costs and free capacity, but until risk clearly eases, schedules and rates will remain less predictable.

Full return via Suez

Transit normalizes on main East-West services. Sailing days and bunkers step down. War-risk lines fade when underwriters ease cover loadings.

Partial return

Select strings re-enter while premium loops stay on the Cape. Capacity stays uneven and rates remain choppy on affected corridors.

Status quo detours

Cape routings persist. Extra days and fuel support freight but lift operating costs. Schedule buffers remain in weekly plans.

Re-escalation

New incidents stall any comeback. War-risk premia rise and more carriers re-route, adding time and bunker burn across networks.

📄 Carrier statements

- Public guidance on routing and timetable restoration cadence.

- Language around crew safety and insurance conditions.

🛡️ Insurance posture

- War-risk rates quoted by leading underwriters.

- Scope of exclusions and required escorts or guards.

⛽ Bunker pull

- Fuel demand shifts that reflect detour persistence or unwind.

- IFO/MGO spreads at bunkering hubs.

🧭 Canal traffic

- Daily transit counts and waiting times published by canal authorities.

- Any restrictions that change slot certainty.

Maersk has publicly said it will resume Red Sea and Suez transits when conditions allow, but it has not set a firm date. Canal officials and some trade outlets suggested an early-December partial restart, which Maersk has not confirmed. Detours have increased global bunker demand and kept war-risk loads elevated; any return will likely be gradual, with network and insurance constraints easing in steps rather than all at once. Longer routings have added meaningful fuel consumption, with analysts estimating roughly +100,000 barrels per day of extra bunker demand at times this year; insurance surcharges on Red Sea passages spiked to around 0.7%–1% of hull value during heightened risk. A durable easing could remove some of these costs, but operators are expected to phase changes carefully.

We welcome your feedback, suggestions, corrections, and ideas for enhancements. Please click here to get in touch.