Drone Strikes Near Odesa as Merchant-Safety Risk Premium Widens

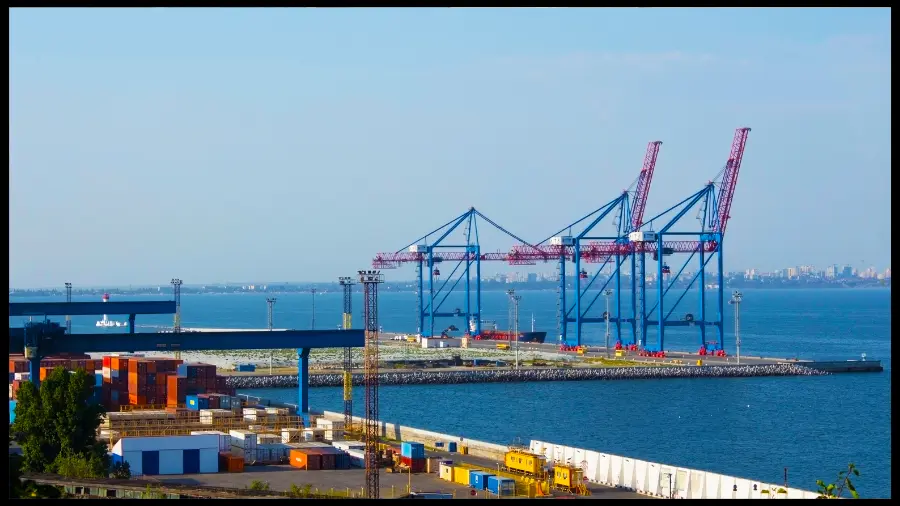

Two foreign-flagged civilian vessels operating around Ukraine’s Odesa region were reported hit by Russian drone strikes on January 9, 2026, with one Syrian national killed and another crew member reported injured. Reuters reported the ships as Wael K (flag Saint Kitts and Nevis) heading to Chornomorsk to load grain, and Ladonna (flag Comoros) near Odesa carrying soybeans. Ukraine’s ports authority has also said attacks on Odesa-region ports rose sharply in 2025, reinforcing why even single incidents can quickly widen the “risk premium gap” between routine voyages and higher-scrutiny legs.

Subscribe to the Ship Universe Weekly Newsletter

Click here for 30 second summary

Civilian ships taking hits near Odesa widens the corridor risk premium gap

Reuters reported two foreign-flagged civilian vessels were struck near Ukraine’s Odesa region on Jan 9, with a Syrian seafarer killed and another person injured. One ship was linked to a grain load at Chornomorsk and the other to soybeans near Odesa. The shipping impact shows up quickly as higher scrutiny and less predictable port-call timing.

-

Friction arrives before freight benchmarks

Owners, charterers, and insurers tend to tighten routines and documentation immediately after a casualty event near an active corridor. -

Effective supply tightens

If a subset of owners avoids the riskiest legs, fewer ships are willing to quote, and voyage time expands through buffers and waiting. -

Clean-chain premium can widen

Transparent operations and lower exposure profiles can price better than higher scrutiny voyages even inside the same basin.

The Odesa corridor remains commercially workable, but casualty events around port approaches reprice risk through insurance posture and time buffers, which can tighten effective tonnage supply and widen the gap between routine and high-scrutiny voyages.

| Signal | Incident tape (reported) | First operational effects | Commercial impact path |

|---|---|---|---|

| Event | Two foreign-flagged civilian vessels reported hit by Russian drone strikes in the Odesa region on Jan 9, 2026. | Voyage instructions tighten quickly around approach windows, watch routines, and corridor discipline. | Even “limited” incidents can widen the gap between routine and high-scrutiny fixtures. |

| Casualty | Ukrainian officials said one Syrian national was killed and another person was injured. | Crew safety becomes a gating question, which can alter willingness to accept the leg. | Higher perceived crew risk feeds into war-risk, P&I attention, and charterparty wording. |

| Vessels named | Images reported showing the names Ladonna and Wael K on the hulls. | Operators re-check AIS tracks, port-call history, and exposure windows for similar profiles. | Clean history and transparent operations price at a premium when scrutiny rises. |

| Flags and cargos | Wael K reported under Saint Kitts and Nevis, sailing to pick up grain at Chornomorsk; Ladonna reported under Comoros, near Odesa carrying soybeans. | Port-call appetite becomes more selective: timing, anchorage exposure, and discharge options matter more. | More selectivity reduces effective tonnage supply by stretching decision and waiting time. |

| Corridor context | The strikes hit shipping tied to Ukraine’s maritime export corridor and Odesa-area ports that handle major commodity flows. | Shippers and terminals build in more buffer, especially around arrival windows. | Schedule reliability worsens first, then pricing adjusts as risk becomes “repeatable.” |

| Attack tempo | Ukraine’s ports authority told Reuters attacks on Odesa-region ports nearly tripled in 2025 to 96. | More frequent incidents raise baseline caution, even for voyages that look operationally similar. | War-risk and delay buffers can become “default” rather than exceptional on exposed legs. |

Odesa corridor risk reprices fast when civilian ships take hits

A casualty event near an active export corridor tends to move markets through friction first: crew exposure questions, insurance posture, port-call appetite, and added buffer time around arrivals. The “risk premium gap” shows up as higher all-in voyage cost and less predictable schedules.

Corridor tape (tight timeline)

Ukraine’s seaport authority saying Odesa-region ports were attacked 96 times in 2025, up from 36 in 2024. That sets a higher baseline for caution on port calls.

Two foreign-flagged civilian ships were reported hit near Odesa, with a Syrian seafarer reported killed and another person injured. Casualties tend to accelerate underwriting and clause reactions.

Operational behavior typically shifts first: tighter approach discipline, more conservative arrival windows, and increased documentation cadence. The rate move can lag the friction move.

Risk-premium gap mechanics (where it forms)

Time expands before price does

Added waiting, slower approaches, and conservative scheduling raise vessel-days consumed per voyage, tightening effective supply without any fleet change.

Underwriting posture reacts to repeatability

When strikes appear pattern-based rather than isolated, quote cycles shorten and information requests get deeper, especially for similar voyages.

Crew risk becomes a commercial variable

Casualty events raise scrutiny on manning, voyage planning, and exposure windows, influencing which owners accept the leg.

A “clean-chain” premium can widen

Transparent ops and lower exposure profiles can price better than ships or voyages viewed as higher scrutiny, even inside the same basin.

How the shipping system feels it first

Effective tonnage supply

Fewer willing ships for the riskiest leg

A small change in participation can tighten capacity quickly when owners selectively avoid specific approaches or ports.

Schedule reliability

Arrival windows become “soft”

Buffer time increases around port calls and anchorages, which propagates into rotation and equipment timing.

Charterparty friction

More scrutiny on risk allocation

Post-incident fixtures tend to spend more time on clauses and documentation expectations than on base freight alone.

Insurance and compliance

Faster reaction than benchmarks

War-risk posture can change quote-by-quote, especially after a casualty event near an active corridor.

Risk Premium Gap Estimator (voyage sensitivity)

A simple way to translate corridor risk into dollars and timing: war-risk style premium, extra delay days, and added security or compliance cost. Output is illustrative and meant for scenario discussion.

War-risk premium (USD)

$0

Premium computed as hull value times percent.

Delay cost (USD)

$0

Delay days times ship cost per day.

Total gap (USD)

$0

War-risk + delay + extra security/compliance cost.

Cost drivers (relative weight)

We welcome your feedback, suggestions, corrections, and ideas for enhancements. Please click here to get in touch.